Venezuela's localization

Cada país maneja sus procesos contables de manera diferente, cada uno tiene sus leyes y reglamentos que marcan las exigencias fiscales, de aquí nace la necesidad de contar con un modulo enfocado 100 porciento a los lineamientos fiscales venezolanos.

Para ello, le ofrecemos el módulo de Venezuela - Contabilidad, Localización contable venezolana Odoo que ofrece un entorno robusto que adapta a los requerimientos que demanda Venezuela desde un punto de vista fiscal y contable.

Tools

Open Source ERP and CRM, Odoo

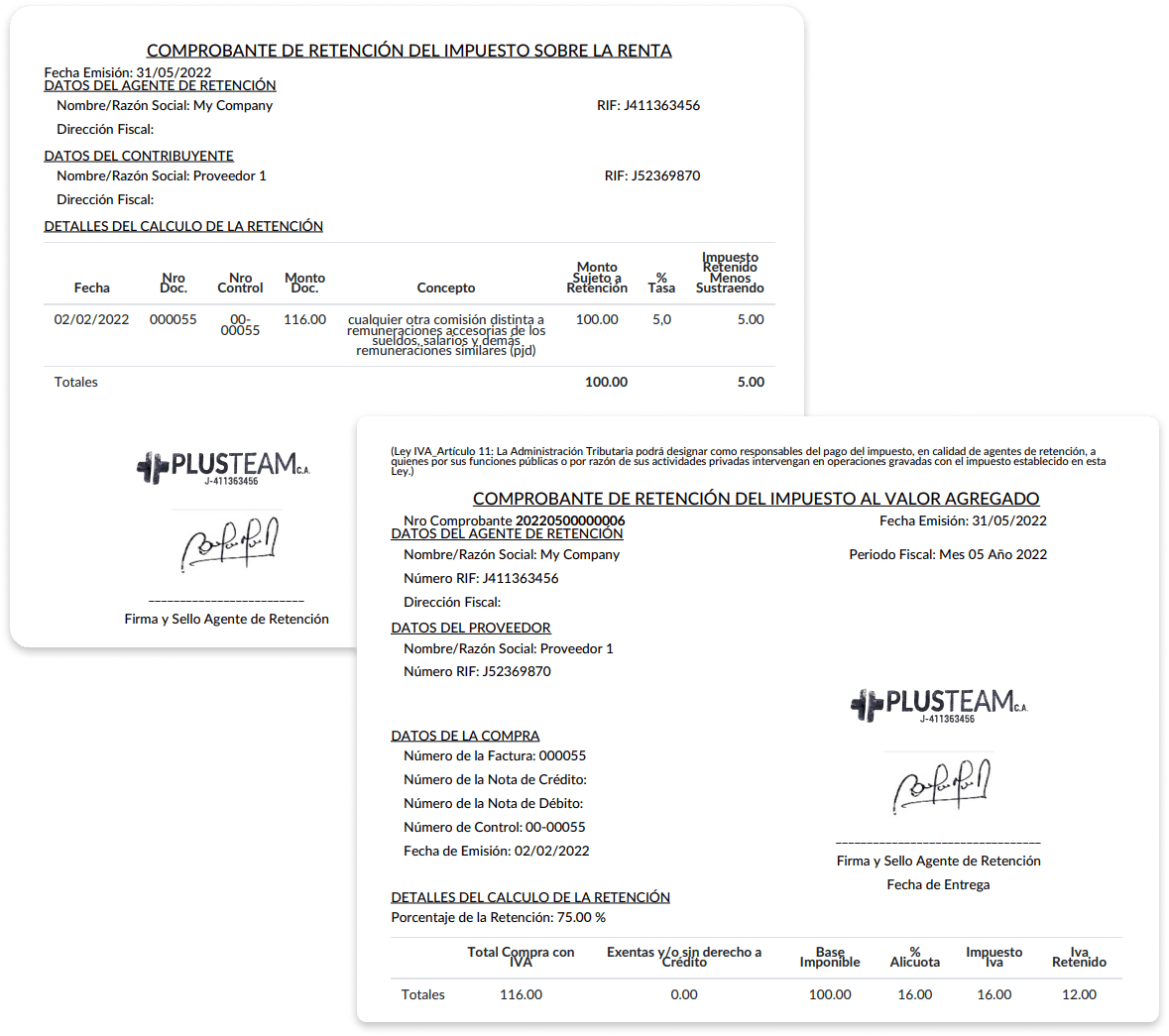

Withholding Process

The Odoo Venezuelan Accounting Location module allows the configuration, application and declaration of legal taxes, according to the guidelines established by SENIAT.

- VAT withholding invoiced for purchases (withholding voucher and its respective report by date period in TXT and PDF for their respective declaration)

- Income tax withholding on the invoiced amount for purchases (withholding voucher and its respective report by date period in XML and PDF for their respective declaration)

- Registration of VAT and ISLR withholdings on sales.

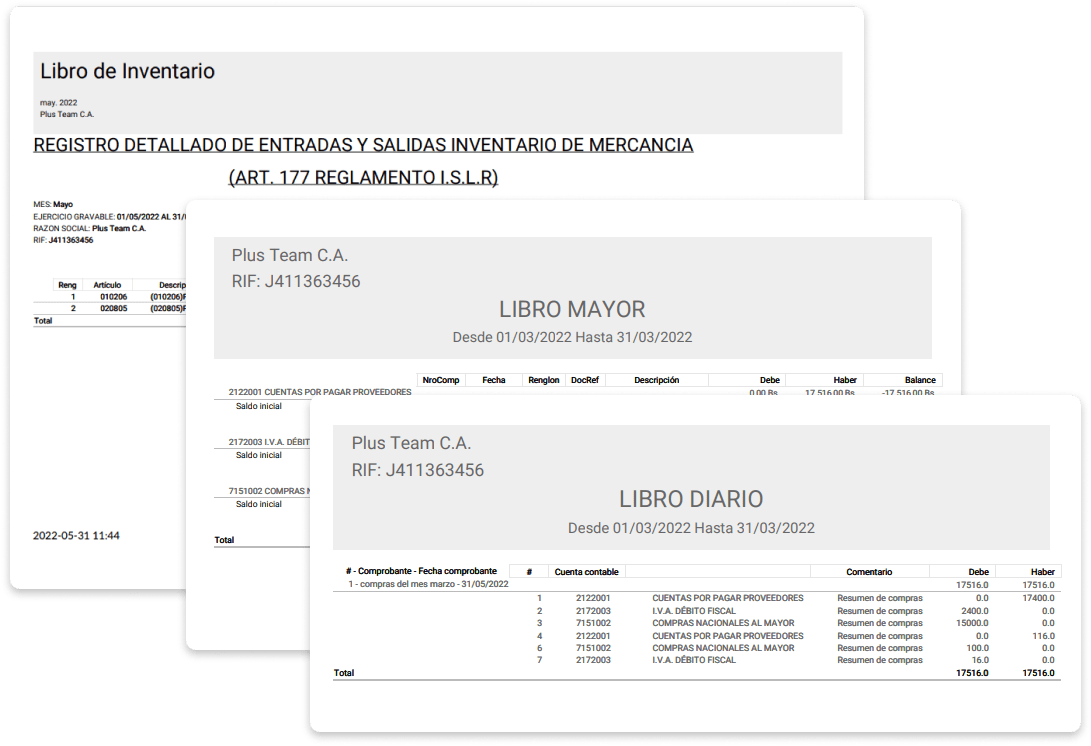

Libros fiscales

- Inventory book

- Journal Book (summary)

- Ledger (summary)

- Sales book

- Purchase book

Books required by SENIAT

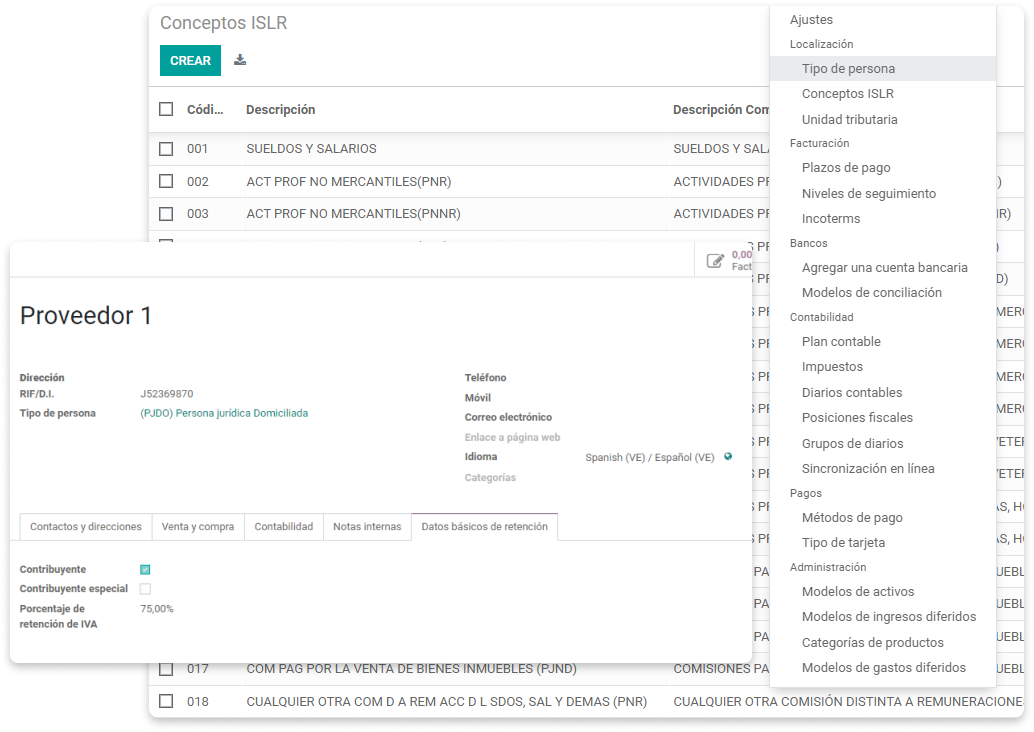

General configuration

- Registration and configuration of tax information for customers and suppliers.

- Point of sale and bank commissions

- Configuration types of people.

- Register ISLR concepts.

- IGTF.

- Registration of seal and signature for withholding vouchers.